News Articles

Health Industry

Unlocking financial success: The power of budgeting for medical practices

By Danny Haydon, Principal/Health Division

7 August 2023

In the ever-evolving landscape of healthcare, medical practices find themselves facing tighter profit margins and greater concerns about cashflow management. Gone are the days when budgeting was an afterthought. Today, it has become a crucial discipline that high-performing practices embrace to optimise their financial performance. Let us delve into the compelling reasons why budgeting should be at the forefront of every medical practice's financial strategy.

Gone are the days of reactive financial management

A startling truth emerges: the majority of medical practices do not utilise budgets to manage their finances effectively. Instead, they rely on comparisons to previous years, only to realise the need for proactive remedial action when it's too late. Waiting until their accountants deliver financial statements leaves them without the power to take timely corrective measures. Budgeting empowers practices to be proactive, making informed decisions that drive financial success.

Budgets: A lifeline during workforce reductions

Imagine a scenario where a medical practice faces a significant reduction in its workforce. In such instances, adjusting the budget becomes crucial, as it highlights whether the practice needs to make tough decisions to adapt to the projected loss of revenue. By analysing the budget, practices can identify areas where expenditures can be reduced while maintaining optimal patient care. Budgeting in times of change ensures that practices weather storms and emerge stronger than ever.

Beyond its financial

advantages, regular reviews

of a practice's performance

against the budget offer

another powerful

benefit.

Boosting financial literacy: A budget's hidden benefit

Beyond its financial advantages, regular reviews of a practice's performance against the budget offer another powerful benefit. Principals with limited financial knowledge can enhance their financial literacy through this process. By understanding the variances between actual results and the budget forecast, these principals gain insights into the sources of any financial problems. This newfound knowledge allows them to implement remediation strategies promptly, effectively bridging the gap between medical expertise and financial acumen.

The art of budgeting unveiled

Budgeting, once seen as a daunting task, is a foundational business discipline that yields remarkable rewards. Let's explore the steps to unlock financial success through effective budgeting.

1. Constructing a financial blueprint

The purpose of budgeting is to create a forecast of revenues and expenditures, providing a model of how a medical practice might perform financially based on strategies, events, and plans. By constructing this financial blueprint, practices can plan their cashflow and anticipate peaks and troughs throughout the year. This enables proactive management of financial operations, with variances between actual results and the forecast acting as guideposts for remedial strategies.

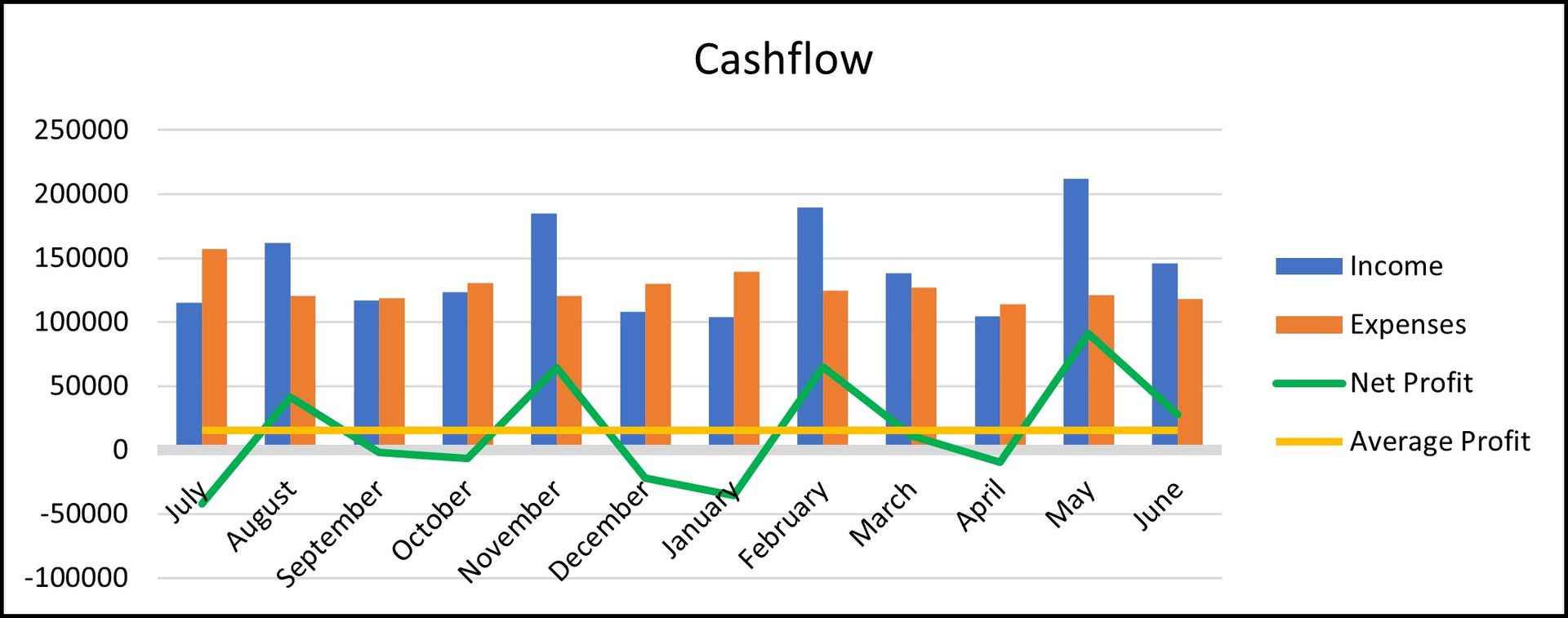

2. Navigating the cashflow journey

Consider the example of a profitable general practice showcased in the diagram. While profitability is evident, there are months throughout the year where a deficit is forecasted. Budgeting helps practices manage their cashflow, ensuring sufficient funds are available to weather the less profitable periods.

3. Where to begin

Embarking on the budgeting journey can be simplified with a few key steps:

- Summarise the most recent financial year on an Excel spreadsheet or use accounting software's budget manager tool to import last year's income and expenses.

- Incorporate projected adjustments of patient fees and related service fees.

- Accommodate changes in staffing levels, adjusting for any known Award or EB conditions.

- Increase overheads by relevant factors such as CPI.

- Convert the annual budget into monthly amounts.

- Establish a regular reporting schedule to review the budget against actual performance.

4. Embracing technology: Accounting software as your ally

Harnessing the power of accounting software presents distinct advantages over traditional spreadsheets. Periodical reports are embedded within the software, eliminating the need for cumbersome data extraction. The process becomes quicker, simpler, and more streamlined. Additionally, specialised tools like Fathom can be used to further enhance the budgeting experience.

Navigating the financial landscape: Balancing income and expense considerations

As part of the budgeting process, practices must carefully consider various income and expense factors:

Income Considerations:

- Expected patient fees: Will there be changes in practitioners' workforce levels? How can income estimates be refined on a per-doctor basis? Are factors such as CPI or other increases taken into account?

- Incentives or grant revenue: Are there any anticipated changes that will impact revenue streams?

- Other income sources: Will rent received or training subsidies experience any expected changes?

Expense Considerations:

- Staffing levels: Will there be changes in the practice's workforce?

- Wage costs: Are there anticipated increases due to CPI adjustments or award changes?

- Rent: Will there be CPI increases or other known changes?

- Computer/IT expenses: Have hardware requirements, software renewals, or staff license considerations been factored in?

- Occupancy costs: Will electricity, rates, or significant repairs impact expenditures?

- Medical supplies: Have anticipated usage changes or cost-saving measures been incorporated?

- Other costs: Are CPI increases or alternative calculations, as well as potential cost-saving measures, considered?

Monitoring progress: From budget to actual performance

Creating a budget is only the beginning. Medical practices must regularly measure their actual performance against the budgeted amounts. Accounting software or Excel can serve as powerful tools for this task. Additionally, specialised programs can extract financial data and generate automated reports, simplifying the measurement process. Reviewing variances, particularly significant ones, on a monthly or quarterly basis becomes paramount. This consistent monitoring empowers practices to optimise financial performance, proactively managing costs and implementing cost-saving strategies when needed.

Conclusion: Empowering financial excellence

Budgeting holds the key to financial success for medical practices in the modern healthcare landscape. By adopting this foundational business discipline, practices can navigate financial challenges, optimise cashflow, and unlock greater financial literacy. The path to financial excellence lies in embracing the power of budgets, transforming reactive financial management into a proactive journey toward a brighter and more prosperous future.

Discuss Further?

If you would like to discuss, please get in touch.

Disclaimer

The information provided in this article does not constitute advice. The information is of a general nature only and does not take into account your individual financial situation. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you contact Brentnalls SA before making any decision to discuss your particular requirements or circumstances.