News Articles

Background

In response to the economic challenges posed by the COVID-19 pandemic, the Australian Government introduced the Temporary Full Expensing initiative on 6 October 2020; aiming to bolster businesses by facilitating investment through immediate deductions for equipment purchases. This initiative, which concluded on 30 June 2023, was designed to stimulate economic activity by allowing businesses with aggregated turnovers of less than $5 billion to access immediate deductions for depreciating assets without any limit. Under this concession, eligible businesses could claim an immediate deduction for the full purchase price of equipment, and any remaining existing small business depreciation pools were reduced to nil and claimed in full.

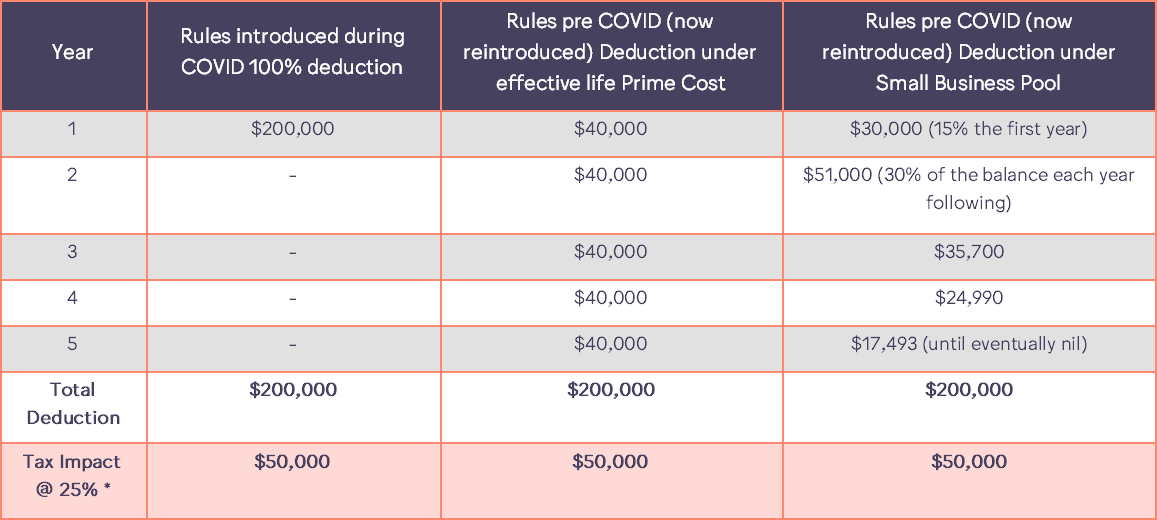

It is crucial to note that while this resulted in a tax deferral, it did not lead to tax minimisation, as it merely accelerated deductions that would have been claimed over several years. For many businesses, the end of the Temporary Full Expensing initiative raises questions about their future tax planning strategies. While the Temporary Full Expensing initiative provided crucial support to businesses during a challenging period, its conclusion necessitates a strategic rethink for businesses navigating the current economic environment.

Implications

Understanding the implications of this initiative and adapting accordingly will be vital for businesses seeking to thrive in the post-pandemic era. We have highlighted the three distinct depreciation methods and their respective implications.

"Understanding the implications of the changes in depreciation concessions is vital for businesses to continue to strive."

* Assuming taxable entity is a base rate entity.

What next?

As at 30 June 2023, most businesses will have depreciating assets with a $nil tax value – this means that when asset are sold, 100% of the proceeds are assessable if the asset has been claimed under the temporary full expensing rules. This creates a tax problem, managing unexpected tax profits on trade-ins of equipment and vehicles.

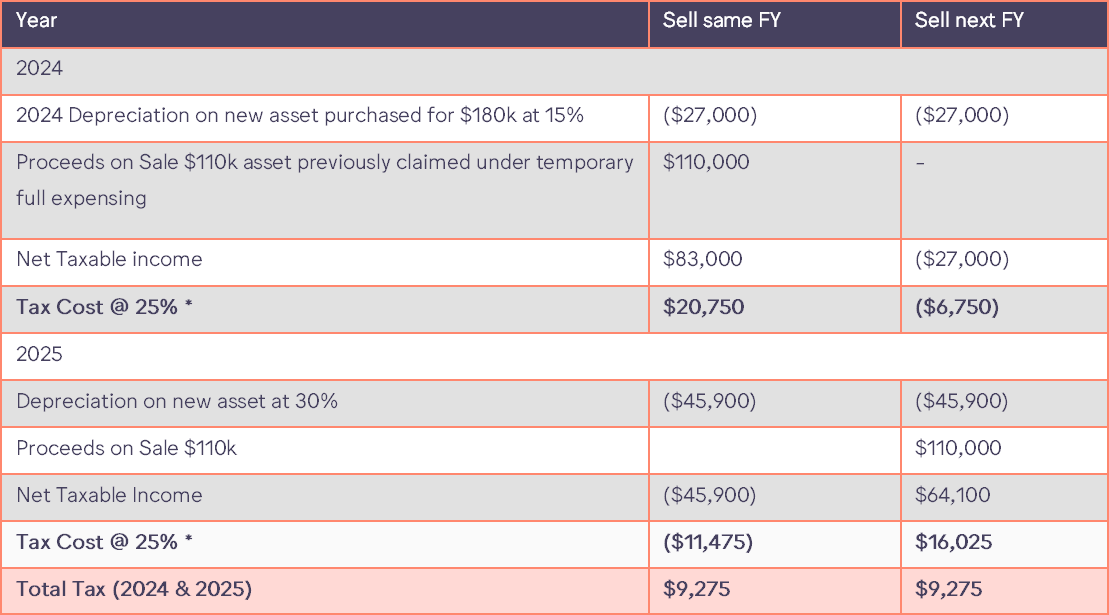

We can see this in a worked example, the business has purchased an excavator for $200,000 on 1 July 2021 and claimed a 100% deduction for the excavator in the 2022 financial year. It is now 1 April 2024 and the business wants to sell the excavator and buy a new excavator for $180,000. The sale price for the current excavator is $110,000. We can see that the business will incur $20,750 in tax payable due to this asset change-over.

Tax trap: Equipment sales / change over and taxable profit

Previously under the old 100% write off rules, if a new asset purchased was more than the old one sold, one would end up with a deduction for the difference. However, from 1 July 2023, the sale proceeds of an asset claimed under temporary full expensing are added to income and only a small claim for depreciation results from the new purchase, typically 15%, resulting in a taxable profit from the changeover. A solution to partly offset this tax issue is to purchase the new asset before 30 June and claim 15% in 2024. Then sell the old asset after 1 July so the sale proceeds are in the 2025 financial year. This will then align with a 30% depreciation deduction in the second year of the new asset ownership, meaning a total of 45% of the new asset will be depreciated by the time the old asset sale proceeds are included in taxable income.

This timing strategy effectively offsets the majority of the sale proceeds with depreciation on the new asset: we note there is different treatment where the asset being sold was previously a small business pool asset and is being replaced with a new pooled asset.

While this timing strategy proves beneficial, it's important to acknowledge that purchasing the new asset before selling the old one may not always be feasible, particularly in cases involving trade-ins.

Another option is to consider purchasing other assets valued at less than $30,000 (immediate write off available) or bringing forward asset purchases without a corresponding changeover. Each scenario requires careful consideration of depreciation coverage and individual business circumstances.

Understanding the implications of the changes in depreciation concessions is vital for businesses to continue to strive. Strategic timing strategies, such as purchasing new assets before selling old ones, can effectively offset sale proceeds with depreciation on a new asset, but feasibility may vary and the rules are complex, requiring careful consideration and review.

Call our team today to discuss end of year tax planning. It can set your business up for the following financial year, backed by the possible benefit of valuable tax savings.

Discuss Further?

If you would like to discuss, please get in touch.

Disclaimer

The information provided in this article does not constitute advice. The information is of a general nature only and does not take into account your individual financial situation. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you contact Brentnalls SA before making any decision to discuss your particular requirements or circumstances.