Budgeting in a Private Practice

Budgeting is the foundational business discipline that high performing practices use for optimising financial performance.

Historically, medical practices have not had to worry about budgeting, but as profit margins have tightened, cashflow management has become a significant concern.

Why Budget?

- The purpose of budgeting is to provide a forecast of revenues and expenditures, i.e. construct a model of how that business might perform financially if certain strategies, events, and plans are carried out.

- This allows the business to plan its cashflow according to the expected peaks and troughs.

- It also enables the actual financial operation of the business to be measured against the forecast and variances highlighted and managed. i.e. If the financial performance is below expectations, budget comparisons enable practices to identify the source of any problems and promptly implement remediation strategies.

- The budget can also be used to predict the impact of a major change to practice operations to support effective decision making e.g. the addition or loss of a practitioner, and the impact of temporary closure.

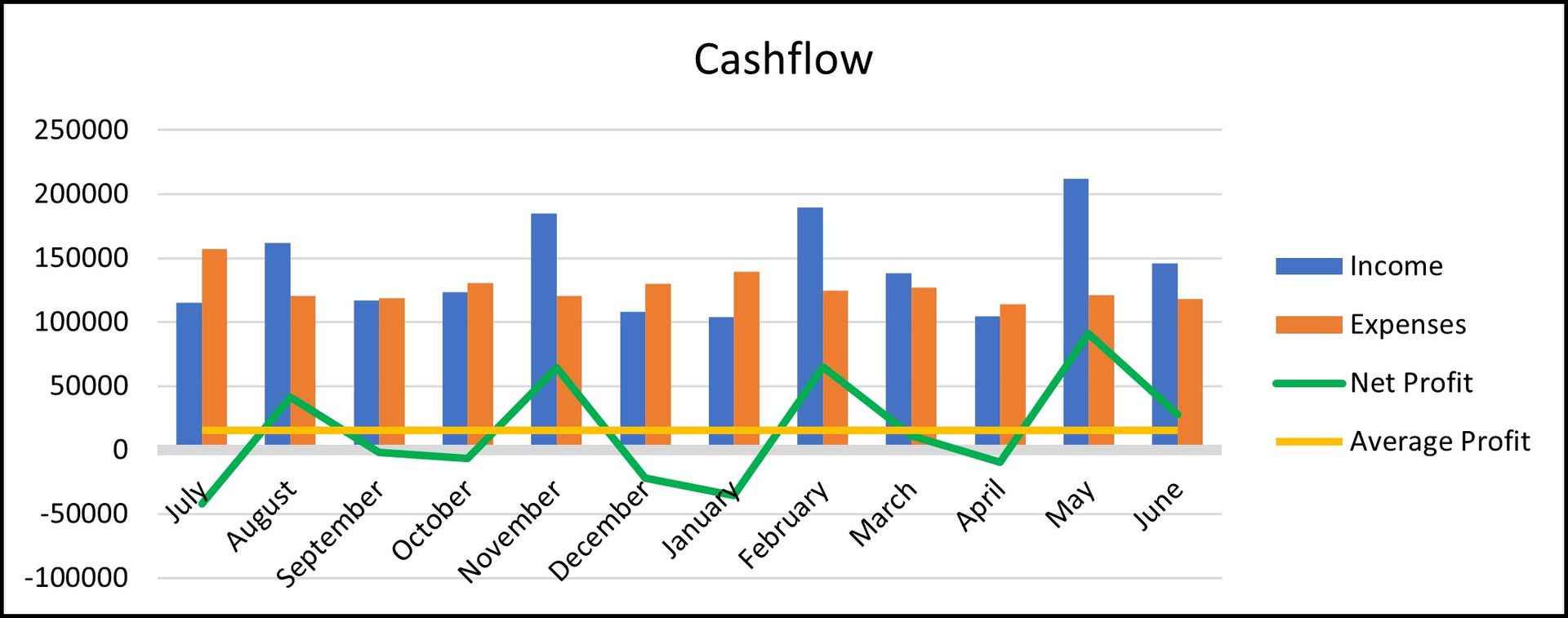

The diagram below is an example of typical cashflow forecast for a profitable general practice, with the quarterly income peaks being the months the Practice Incentive Payments are received. Even though the practice is profitable, there are several months throughout the year a deficit is forecast. The budgeting process enables the practice to manage their cashflow so that there is sufficient funds in hand to manage through the less profitable months.

Where to start?

- Either summarise the most recent financial year on an Excel spreadsheet or use your accounting software budget manager tool to bring through last year's income and expenses in the budget.

- Incorporate the projected adjustments to income and expenditure.

- Convert the annual budget (Income & Expenditure) into per month amounts.

- Establish a monthly reporting schedule to review the budget against your actual performance.

Budgeting is not difficult and once the process is established, it is easier in subsequent years.

An advantage of using the accounting software over Excel is that the periodical reports are embedded in the product and can be produced without needing to extract the data to an Excel spreadsheet, and it's also a much simpler and quicker process.

Income Considerations

- Expected Patient Fees

- GP staffing levels - will this remain stable or change in the upcoming year?

- Income estimate on per doctor approach?

- CPI or other increase factor?

- Practice Incentives Income – are there any expected changes?

- Other income (rent received, training subsidies) - are there any expected changes?

Expense Considerations

- Staffing Levels – will there be changes?

- Increased wage costs (CPI or award changes)

- Rent – CPI increase or known change?

- Computer / IT expenses – staff licences, hardware requirements, software renewals?

- Occupancy costs – electricity increases, rates, significant repairs required?

- Medical supplies – CPI increase or change re anticipated usage, cost savings?

- Other costs – CPI increase or other calculation, cost savings.

Measurement

Once the budget has been established, your accounting software (or Excel) can be used to measure actual performance against the budgeted amounts. There are also programs available, such as Fathom, that can extract the financial data from your accounting software to prepare automated financial reports.

It is important to review any variances (particularly significant ones) monthly or quarterly and investigate the reasons for these variances. Regular monitoring of the budget position is the most important discipline of budgeting and provides the insights that enable businesses to optimise financial performance. By keeping track of expenses and variances to budgeted amounts, businesses can be more proactive with managing costs where they exceed budgets and placing cost saving strategies into place when required.

Discuss Further?

If you would like to discuss this, please get in touch.

Disclaimer

The information provided in this information sheet does not constitute advice. The information is of a general nature only and does not take into account your individual situation. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you contact Brentnalls SA before making any decision to discuss your particular requirements or circumstances.