News Articles

Health Industry

Navigating the payroll tax crisis: Challenges facing medical practices across Australia

13 May 2024

While the focus of the payroll tax crisis has been on the GP sector, the issue is not limited to general practice and is likely to have a profound impact on privately operated health practices throughout Australia, including specialist, dental, and allied health practices.

What is Payroll Tax?

Payroll tax is a state-based tax levied on the wages paid by employers. The tax rate and threshold vary across different states and territories in Australia. Typically, businesses are required to pay payroll tax if their total wage bill exceeds the specified threshold, which varies from state to state (further details in this article).

There is no question that medical practices that exceed the threshold for employee remuneration need to pay payroll tax. The critical question in this crisis is whether the remuneration received by independent practitioners working within medical practices is assessable for payroll tax.

This issue has been percolating for several years due to several cases brought by state revenue offices to retrospectively assess payroll tax on payments made to various practitioners. This action signalled a change in the interpretation of the Payroll Tax Act in respect to independent practitioner arrangements that were previously thought to be exempt if set up correctly.

Revenue SA Payroll Tax Amnesty for General Practices

The outcome of the Revenue SA payroll tax amnesty for general practices should have delivered greater clarity for medical practices in SA and across state borders. For the vast majority of practices that applied for the amnesty, the key outcomes were:

- Their service agreements are determined to be Relevant Contracts under the payroll tax relevant contractors provisions, meaning payments to the practitioner are assessable for payroll tax.

- Practices were granted amnesty from retrospective action by Revenue SA.

- Practices were advised that payments made to practitioners would be assessable from 1 July 2024.

The contentious part in reference to 3. is the question of what constitutes a “payment”.

The appeal of the Thomas and Naaz case to the Supreme Court Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2023] NSWCA 40 offers some guidance for the management of Independent Practitioners' payments. Section 63 of the ruling indicates that if patient fees are paid directly to the practitioner, and the only transaction between the practitioner and the practice is the payment of the service fee, then there is no payment from the practice to the practitioner that would be deemed assessable wages for payroll tax purposes.

As a consequence of this ruling, practices across Australia have been advised to direct patient fees owed to independent medical practitioners into the practitioner’s bank account.

Queensland Revenue Office’s (QRO) Public Ruling PTAQ000.6.21 issued 21 February 2024 affirms in paragraphs 47, 56-62, that where payments of patient fees are paid directly to the practitioner, these payments are not assessable for payroll tax.

The payroll tax rulings issued by the SA, NSW and Victorian Revenue Offices have no such paragraph and Revenue SA, has indicated to practices, that they do not apply the same interpretation of the Act and their view is that the payments by patients and Medicare into practitioners' individual bank accounts are "Third-Party Payments" that are assessable for payroll tax.

What about Harmonisation?

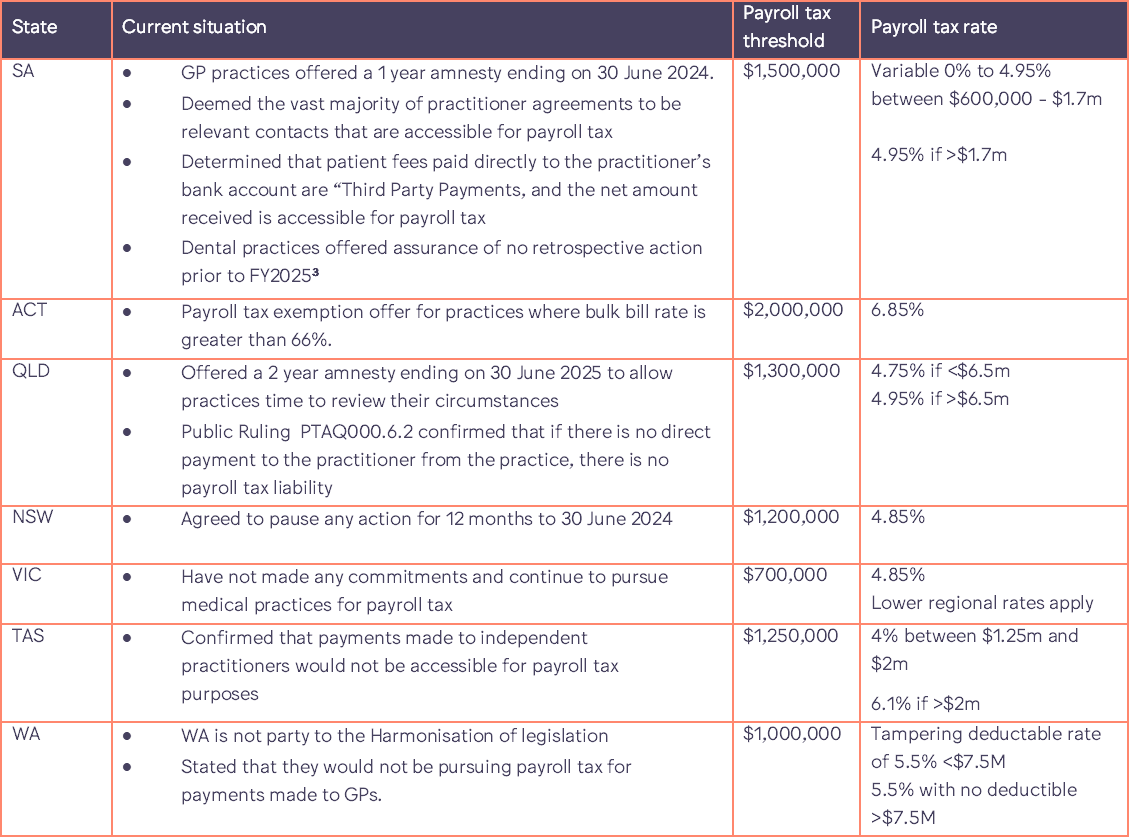

Aside from Western Australia, the payroll tax legislation is meant to be harmonised to deliver a National Seamless Economy 2010 Harmonisation Joint Protocol | Payroll Tax2. The table below summarises the current state of play across all states demonstrating that these recent developments have created disharmony and confusion for medical practices across Australia. As practices seek to navigate the murky situation where the business viability of running a medical practice could depend very much on which state the practice is located.

Unfortunately, it appears that until Revenue SA’s interpretation is legally contested, there is unlikely to be a clear and harmonised state of play across Australia.

What can practices do?

1. Increase patients' fees

It is reported that practices are being advised to significantly increase their fees to cover the additional cost of payroll tax. However, this strategy means that the practitioner is retaining the majority of that revenue and the practice is only gaining the portion from the associated service fees.

Increasing the practitioner’s net income also increases the practitioner's remuneration for payroll tax purposes and the amount of payroll tax to be paid.

Practices with high bulk-bill rates would need to increase private patients' fees to an unaffordable level to generate sufficient additional revenue to fund payroll tax.

2. Increase service fees

Practices are also considering increasing the service fees charged to the practitioners, but this is difficult to do particularly with the current workforce shortage across most sectors.

3. Charge a payroll tax fee

It has been reported that some practices have already added or are considering adding a payroll tax fee as an additional cost on each invoice. The fee is then clawed back from the revenue received by the practitioner in addition to the service fees being charged.

A payroll tax fee can only be charged on a private fee so practices with high bulk billing rates would again find it more difficult to raise the funds necessary to cover the additional payroll tax burden.

4. Prepare for the worst

Payroll tax will continue to be the hot topic for medical practices across Australia, and there is still more of this saga to play out across the various states. The current state of confusion and disharmony is only likely to get resolved when a Court determines which of the state’s interpretations is correct.

For the time being, at least in South Australia, all medical practices need to be considering their payroll tax strategy to ensure that they are not caught with an unexpected payroll tax bill. This is particularly critical for specialist and allied health practices that do not have any assurances from the SA Government protecting them from retrospective action.

Conclusion

The payroll tax crisis presents a formidable challenge for medical practices across Australia, threatening their financial sustainability and ability to deliver essential healthcare services to communities nationwide. Addressing this crisis requires concerted action from government, industry stakeholders, and the broader community to enact meaningful reforms that support the viability of medical practices and ensure continued access to quality healthcare for all Australians.

Previously written articles:

MyMedicare: The foundation for funding reform for general practice

Disclaimer

The information provided in this article does not constitute advice. The information is of a general nature only and does not take into account your individual financial situation. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you contact Brentnalls SA before making any decision to discuss your particular requirements or circumstances.