Constitutionally Protected Funds

Constitutionally Protected Funds (CPFs) are untaxed super funds that do not pay income tax on concessional contributions or on earnings they receive.

CPFs are operated by some state governments in Australia for their employees, for example, the Super SA Triple S Fund. Under the Australian Constitution, state government assets can't be taxed so different arrangements apply to concessional contributions to CPFs.

Contributions

Contributions that are made, or allocated to, a CPF on or after 1 July 2017 are counted toward an individual's concessional contributions cap. However, these contributions and amounts, on their own, cannot result in excess concessional contributions. The concessional contributions are not subject to contributions tax of 15% in the fund. Instead they are applied to a lifetime untaxed plan cap of $1,780,000 (2024/2025) which is indexed in accordance with section 960-285 of ITAA 1997 to average weekly ordinary times earnings (AWOTE) and will increase in amounts of $5,000.

When contributing to other super funds, care needs to be taken if contributing over $30,000 to the CPF as $1 to another fund will trigger an excess contribution.

Contribution splitting is available within most CPFs but each fund offering this service may set its own rules to administer the process, as the regulations are not fully prescriptive. Within the Super SA Triple S fund you are able to establish a spouse account (if your spouse does not have their own account with Super SA) and split your concessional contributions to your spouse's account. The application to split contributions should be lodged in the year in which the contributions were made. The contributions will then be transferred to your spouse's account the following financial year. This strategy will reallocate the concessional contributions from counting towards your untaxed plan cap and will now be allocated to your spouse's untaxed plan cap.

The following conditions must be met by the receiving spouse:

- Must be under preservation age (this could be between 55 and 60, depending on your date of birth) or

- Over preservation age but under 65 and not retired from the workforce.

The purpose of this criteria is to ensure that contributions split to the spouse are transferred as preserved amounts and not used as a means to gain early access to superannuation benefits via a non-working spouse who has already reached preservation age.

Any non-concessional contributions are counted towards your non-concessional contributions cap.

Surcharge

The superannuation surcharge was a tax imposed by the Commonwealth Government on your surchargeable contributions once your income reached certain levels. It applied if your adjusted taxable income for the financial year exceeded the threshold set by the Australian Taxation Office. The tax was introduced on 20 August 1996 and levied until 30 June 2005.

Any surcharge liability accrued prior to 1 July 2005 will be payable when you withdraw or roll over your full entitlement upon leaving your CPF.

Interest is accrued on your surcharge debt by the ATO On 30 June each year. When you receive your full entitlements from the CPF the ATO will calculate your final outstanding surcharge debt including interest. You will have 3 months from the date of issue by the ATO to make payment of your surcharge debt before general interest charge is then applied to it. However, you can elect to use a portion of your super entitlement to pay any outstanding surcharge liability.

Components of Super Balance

Since 1 July 2007, all superannuation fund balances have been classified as either tax-free or taxable components.

Tax free components are tax free when paid and consists of:

- Any crystallised amount calculated at 30 June 2007, plus

- Non-concessional contributions made after 1 July 2007.

Taxable components of a superannuation balance includes concessional contributions and earnings which have been taxed at 15%.

It comprises of two elements:

- A taxed element, and

- An untaxed element.

Super SA Information

If you have an account with Super SA Triple S Fund and would like to find out what your current level of contributions are that has been applied to the untaxed plan cap, you need to contact them on 1300 369 315. You will need to provide them with the following information: full name, address, date of birth, employing agency, and super ID number (found on your annual statement).

CPFs are untaxed funds and therefore their balances consist mainly of a taxable component with an untaxed element. This means that the tax is deferred until the funds are withdrawn or rolled out of the fund.

Lump Sum Withdrawals from CPFs

Once you have met a condition of release and are eligible to take your superannuation benefits as a lump sum you will be taxed as follows:

Commencing an Income Stream Within a CPF

While your superannuation balance is within accumulation phase, it is held within a CPFs accumulation fund product such as the "Triple S Fund". When you meet a condition of release and become eligible to commence an income stream your superannuation balance will be rolled from one fund product into a new income stream product offered by the CPF, for example, "Super SA Income Stream".

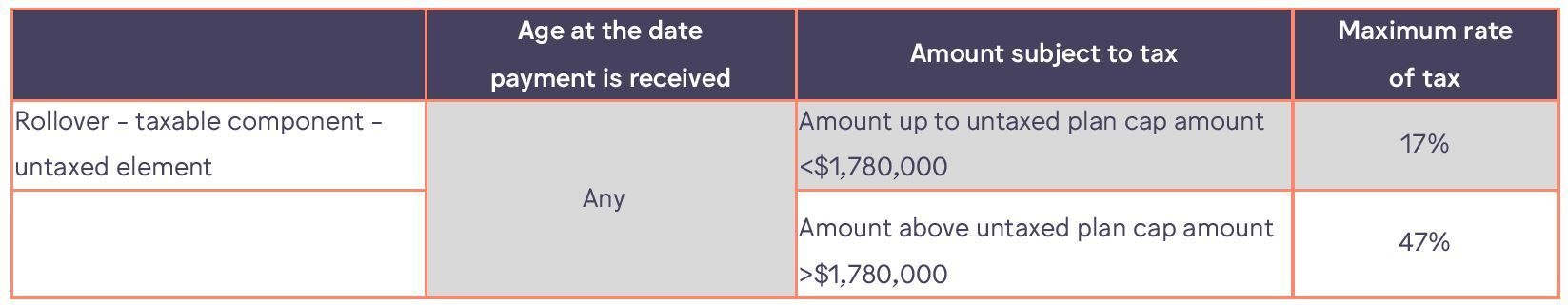

On rolling your superannuation benefits into an income stream product, your untaxed element of your balance will be subjected to tax at the same rates as if you rolled over your superannuation fund balance into another complying superannuation fund. The tax is applied as follows:

Individuals whose income and relevant concessionally taxed super contributions exceed $250,000 per annum are required to pay 15% tax on the amount of relevant concessional contributions which exceed the $250,000.

Income streams taken by members over the age of 60 from a complying superannuation fund are tax free. If you are under 60 years, the income will be taxable but you will receive a 15% tax offset.

Tax planning should be reviewed when you are considering accessing your funds from a CPF.

Discuss Further?

If you would like to discuss this, please get in touch.

Disclaimer

The information provided in this information sheet does not constitute advice. The information is of a general nature only and does not take into account your individual financial situation. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you contact Brentnalls SA before making any decision to discuss your particular requirements or circumstances.